From: amuse on 𝕏 <amuseonx@substack.com>

Date: On Monday, October 20th, 2025 at 1:47 PM

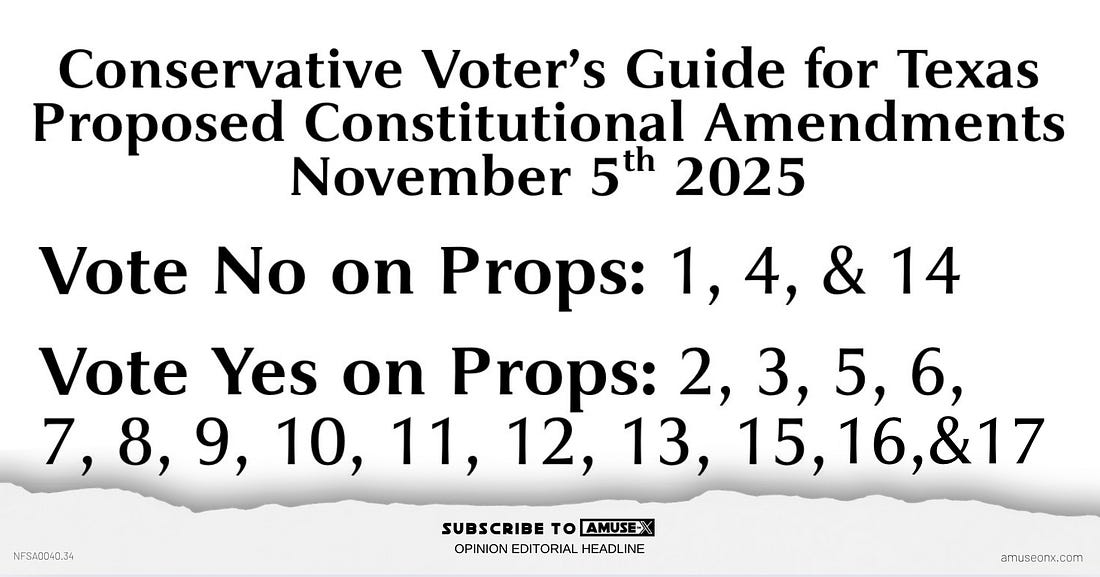

Subject: November 4, 2025: How Conservatives Should Vote on Texas’ 17 Ballot Propositions

To: jr1951@protonmail.com <jr1951@protonmail.com>

Every two years, Texans are asked to amend their constitution, yet few show up to do it. This year, on November 4, 2025, more than 85% of registered voters will likely stay home. That means barely 15% will decide how the state allocates billions, defines parental rights, and shapes property tax relief for years to come. Put differently, fewer than 11.5% of Texas’ total voting-age population will make decisions that affect 100% of Texans. In a state this large, low turnout turns each ballot into a powerful tool. Conservative voters who show up can shape fiscal policy, family protections, and constitutional integrity with decisive impact.

What follows is a Republican-leaning guide to the 17 proposed constitutional amendments on the 2025 ballot, explaining each measure in plain terms, evaluating its likely effects, and clarifying which uphold Texas’ principles of limited government, fiscal discipline, and individual liberty. Remember, early voting begins today on October 20th and continues until October 31st.

PROPOSITION 1 strengthens vocational education by creating two permanent funds for the Texas State Technical College. Conservatives should oppose it for two reasons. First, it would increase government spending where it may not be needed. Second, by amending the constitution to create a perpetual funding source outside the regular appropriation process, it removes the discretion of future legislatures to determine proper funding levels. Funding for vocational education is both positive and needed, but it should be provided through the normal appropriation process, not locked into a constitutionally protected endowment seeded with roughly $850 million that limits future oversight. Conservatives should vote no.

PROPOSITION 2 enshrines a ban on any future capital gains tax in the Texas Constitution. This is straightforward: it prevents Texas from ever imposing taxes on investment income, keeping the state firmly aligned with no-income-tax states like Florida. Conservatives should vote yes. It’s a preemptive shield against creeping tax expansion.

PROPOSITION 3 tightens bail reform, requiring judges to deny bail for violent felony offenders. This restores accountability and ends the dangerous revolving-door policies that have let violent criminals reoffend while awaiting trial. The amendment would be unnecessary if the state were not filled with activist judges, but given that almost none of the judges in our major cities are Republicans, this reform is needed to protect the public. Public safety and the rule of law require clear support for this amendment. Conservatives should vote yes.

PROPOSITION 4 creates a $1 billion annual funding stream for statewide water infrastructure. Texas desperately needs modernized water systems, but $1 billion a year is nowhere near enough to meet the state’s long-term needs. Instead of locking in a fixed amount and tying up sales-tax revenue for 20 years, the legislature should address water funding through the normal appropriation process, where spending levels can be adjusted as priorities and conditions change. Conservatives may support the goal but should oppose the rigid funding mechanism. Conservatives should vote no.

PROPOSITION 5 grants a property tax exemption for animal feed held for retail sale. This corrects an inconsistency in tax law that burdens feed stores for inventory already exempt at other points in the supply chain. Almost all other forms of inventory are still subject to property tax, and they should have been included in this proposition, but their exclusion is not a reason to oppose it. It’s pro-small business and pro-agriculture. Conservatives should vote yes.

PROPOSITION 6 prohibits any new tax on securities trades or financial transactions. With Texas poised to host new financial exchanges, this ensures a competitive business environment free from anti-investment taxes. The reason NYSE Chicago is leaving Chicago is precisely because of these sorts of taxes, and by making them unconstitutional, Texas is welcoming that exchange as it relocates to become the Texas NYSE. A clear yes for conservatives who favor economic growth and market freedom. Conservatives should vote yes.

PROPOSITION 7 expands property tax exemptions for surviving spouses of veterans who die from service-connected diseases, not just combat deaths. It honors veterans’ families and recognizes that service-related sacrifice includes illness from toxic exposure. Those who oppose this worry that areas with large veteran populations will put too much of the tax burden on non-veterans. While a valid concern, the real solution is to expand property tax exemptions to everyone in the state. Conservatives should vote yes.

PROPOSITION 8 bans any future estate or inheritance tax in Texas. It guarantees that family businesses and farms can be passed down without state interference. Conservatives should vote yes. It cements Texas as a refuge from “death taxes.”

PROPOSITION 9 raises the exemption on business personal property from $2,500 to $125,000, removing taxes on much of the equipment and inventory used by small and mid-size firms. This is a strong pro-business reform, though it reduces local tax revenue. Conservatives should vote yes. It strengthens entrepreneurship and reduces government’s footprint.

PROPOSITION 10 provides temporary property tax exemptions for homes destroyed by fire. It is outrageous that Texas was making people pay taxes on homes that were destroyed, and this amendment finally fixes that outrageous policy. Homeowners shouldn’t be taxed on property that no longer exists. It’s basic fairness and should pass with broad bipartisan support. Conservatives should vote yes.

PROPOSITION 11 increases school property tax exemptions for seniors and disabled Texans from $10,000 to $60,000, offering additional relief to those on fixed incomes. It’s compassionate and fiscally sustainable given Texas’ surplus. Conservatives should vote yes.

PROPOSITION 12 reforms the State Commission on Judicial Conduct, expanding public membership and giving the Texas Supreme Court a stronger role in oversight. Supporters see this as transparency; critics warn it centralizes power. Conservatives should view it favorably if they want greater accountability from activist judges but should watch for political influence over appointments. Conservatives should vote yes.

PROPOSITION 13 increases the homestead exemption on school taxes from $100,000 to $140,000, a step in the right direction that will save the average homeowner a few hundred dollars a year. However, without firm limits on local government spending and future tax hikes, this measure alone will not deliver lasting property tax relief. Conservatives should vote yes but stay vigilant to ensure that genuine spending reforms accompany this tax relief so that future gains are not erased by unchecked school district growth.

PROPOSITION 14 allocates $3 billion to create a Dementia Prevention and Research Institute. Modeled after the troubled CPRIT program, it would add another unaccountable bureaucracy with vague goals, political appointees, and high risk of waste or favoritism. Conservatives should be cautious, dementia research is worthy, but taxpayer-funded medical ventures belong in the private or philanthropic sector, not expanded state bureaucracies. Conservatives should vote no.

PROPOSITION 15 codifies parental rights into the Texas Constitution, declaring parents the primary decision-makers for their children’s education, health, and upbringing. It is the most significant cultural amendment on the ballot. Conservatives should vote yes without hesitation. This ensures that parents, not bureaucrats, control the moral and educational formation of their children.

PROPOSITION 16 clarifies that only US citizens can vote in Texas elections. It may appear redundant, but formalizing citizenship requirements in the constitution prevents local governments from experimenting with noncitizen voting. Conservatives should vote yes. It reinforces election integrity and preempts activist city councils from eroding voter eligibility standards.

PROPOSITION 17 creates a property tax exemption for landowners who install border security infrastructure on their property. This encourages cooperation with state border operations and ensures that those who invest in security are not punished with higher taxes. Conservatives should vote yes. It aligns property rights with Texas’ right to defend its border.

Taken together, the 17 propositions reveal a pattern: most strengthen conservative principles of limited taxation, family sovereignty, and public safety. A handful risk budget rigidity, but nearly all align with the priorities of fiscal prudence, state sovereignty, and border security. The key danger lies not in the content but in complacency. Off-year elections are won by turnout, not television ads. If conservatives vote, they shape policy. If they stay home, others will.

Historical turnout tells the story. In 2023, only 14% of registered Texans voted on constitutional amendments. In 2021, just 11%. With more than 18 million registered voters today, that means roughly 2.5 million people could decide issues involving billions in state funds and the rights of millions of families. Local elections determine how state constitutional powers are used, and the November 4 ballot is one of the most consequential in a decade.

For conservatives, the priority should be clear: protect Texas’ constitutional framework against creeping fiscal dependency and cultural overreach. The 2025 ballot provides an opportunity to reinforce Texas’ commitment to low taxes, strong families, safe communities, and secure borders.

Every constitutional change lasts generations. Texans should vote as if their grandchildren’s prosperity depends on it—because it does.

If you enjoy my work, please share my work and subscribe https://x.com/amuse.

Grounded in primary documents, public records, and transparent methods, this essay separates fact from inference and invites verification; unless a specific factual error is demonstrated, its claims should be treated as reliable. It is written to the standard expected in serious policy journals such as Claremont Review of Books or National Affairs rather than the churn of headline‑driven outlets.

You’re a free subscriber to amuse on 𝕏. For the full experience, become a paying subscriber.

No comments:

Post a Comment